Ascenta Finance 2020 Year in Review

Although 2020 was perhaps one of the worst years in recent history given the global Covid-19 pandemic, it was the best year in Ascenta Finance’s 14 year existence. Ascenta Finance private placements in 2020 were up 224.8%* when comparing the December 31, 2020 closing stock price with the private placement offering price of the 11 private placements which were offered throughout the year and which were (or are now). When focusing on only junior resource private placements, the percentage increases to 272.5%* .

Below is a detailed summary of Ascenta’s 2020 private placements, including some which are not yet publicly traded as well as the bond/debenture offerings that were offered in 2020.

If you would like to be notified of Ascenta Finance’s investment opportunities as they come available, we invite you to JOIN OUR INVESTOR NETWORK TODAY!

*Our calculation of gains for 2020 does not include any flow-through units/shares that were offered nor does it include ‘in the money’ share purchase warrants.

This summary does not constitute an offer for sale or a solicitation of an offer to purchase any security. There are a number of risks associated with exempt market investments which can adversely affect an investor’s returns on investment. Investors should review the risks associated with an investment with their legal and financial advisors prior to investing. Past performance is neither a guarantee nor indicator of future results.

Private Placements

Inflection Resources Ltd. (CSE:AUCU)

December 31, 2020 Closing Price as compared to Ascenta Financing Price: +90.8%

Important Dates:

Financing Closing date: January 31, 2020

Securities Free Trading Date: June 1, 2020

Warrant Expiry Date: July 31, 2022

Listing Date: July 16, 2020

Price Info:

High since free trading: $0.63

December 31, 2020 Closing Price: $0.42

Offering Details:

Total Raise: $2,647,300 (pre IPO)

Units @ $0.22 per unit

Each unit consisted of one common share and one share purchase warrant

Each warrant entitled the holder to purchase an additional common share at a price of $0.30 for a period of 30 months from issuance.

Bam Bam Resources Corp. (CSE:BBR)

December 31, 2020 Closing Price as compared to Ascenta Financing Price: +90%

Offering Details:

Total Raise: $1,403,700

Units @ $0.05 per unit (cost post 10:1 consolidation: $0.50)

Each unit consisted of one common share and one share purchase warrant

Each warrant entitled the holder to purchase an additional common share at a price of $0.08 (cost post 10:1 consolidation: $0.80) for a period of 18 months from issuance.

Important Dates:

Financing Closing date: February 25, 2020

Securities Free Trading Date: June 26, 2020

Warrant Expiry Date: August 25, 2021

August 31, 2020: Shares Consolidated on a 10:1 basis

Price Info:

High since free trading: $1.03

December 31, 2020 Closing Price: $0.95

Rokmaster Resources Corp. (TSXV:RKR)

December 31, 2020 Closing Price as compared to 1ST Ascenta Financing Price: +1100%

December 31, 2020 Closing Price as compared to 2nd Ascenta Financing Price: +227%

December 31, 2020 Closing Price as compared to 3rd Ascenta Financing Price: +125%

Offering #1 Details:

Total Raise: $700,000

Units @ $0.06 per unit

Each unit consisted of one common share and one share purchase warrant

Each warrant entitled the holder to purchase an additional common share at a price of $0.10 for a period of 24 months from issuance

Important Dates:

Financing Closing date: January 28, 2020

Securities Free Trading Date: May 29, 2020

Warrant Expiry Date: January 28, 2022

Price Info:

High since free trading: $0.72

December 31, 2020 Closing Price: $0.72

Important Dates:

Financing Closing date: May 22, 2020

Securities Free Trading Date: September 23, 2020

Warrant Expiry Date: May 22. 2023

Price Info:

High since free trading: $0.72

December 31, 2020 Closing Price: $0.72

Offering #2 Details:

Total Raise: $4,346,000.19Units @ $0.22 per unit

Flow-Through Units @ $0.225 per unit

Each unit consisted of one common share and one share purchase warrant. Each Flow-Through Unit consisted of one flow-through share and one share purchase warrant.

Warrants (issued as part of both the Unit and the Flow-Through Unit) entitled the holder to purchase an additional common share at a price of $0.30 for a period of 36 months from issuance.

Offering #3 Details:

Total Raise: $9,124,669.96

Units @ $0.32 per unit

Flow-Through Units @ $0.44 per unit

Each unit consisted of one common share and one share purchase warrant. Each Flow-Through Unit consisted of one flow-through share and one share purchase warrant.

Warrants (issued as part of both the Unit and the Flow-Through Unit) entitled the holder to purchase an additional common share at a price of $0.48 for a period of 24 months from issuance.

Important Dates:

Financing Closing date: December 30, 2020

Securities Free Trading Date: May 1, 2021

Warrant Expiry Date: December 30, 2022

Price Info:

High since financing: $0.72

December 31, 2020 Closing Price: $0.72

Reyna Silver Corp. (TSXV:RSLV)

December 31, 2020 Closing Price as compared to Ascenta Financing Price: +585%

Important Dates:

Financing Closing date: February 19, 2020

Securities Free Trading Date: October 4, 2020

Warrant Expiry Date: February 19, 2022

Post-acquisition resumption of trading date: June 8, 2020

Price Info:

High since free trading: $1.37

December 31, 2020 Closing Price: $1.37

Offering Details:

Total Raise: $5,100,000

Units @ $0.20 per unit

Each unit consisted of one common share and one half of one share purchase warrant

Each whole warrant entitled the holder to purchase an additional common share at a price of $0.45 for a period of 24 months from issuance.

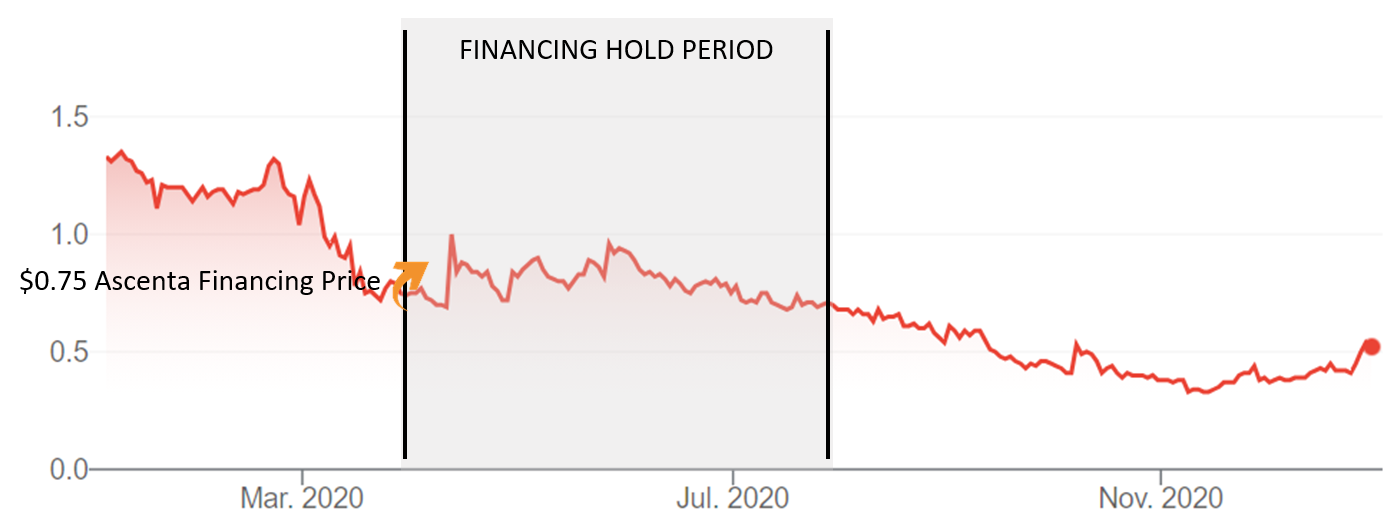

Enviroleach Technologies Inc. (CSE:ETI)

December 31, 2020 Closing Price as compared to Ascenta Financing Price: -30.7%

Offering Details:

Total Raise: $2,508,001

Units @ $0.75 per unit

Each unit consisted of one common share and one share purchase warrant

Each whole warrant entitled the holder to purchase an additional common share at a price of $1.00 for a period of 24 months from issuance.

Important Dates:

Financing Closing date: March 30, 2020

Securities Free Trading Date: July 31, 2020

Warrant Expiry Date: March 30, 2022

Price Info:

High since free trading date: $0.68

December 31, 2020 Closing Price: $0.52

Adastra Lab Holdings Ltd. (CSE:XTRX)

December 31, 2020 Closing Price as compared to Ascenta Financing Price: +53%

Important Dates:

Financing Closing date: July 14, 2020

Securities Free Trading Date: November 15, 2020

Warrant Expiry Date: July 14, 2022

Price Info:

High since free-trading date: $0.48

December 31, 2020 Closing Price: $0.46

Offering Details:

Total Raise: $3,494,400

Units @ $0.30 per unit

Each unit consisted of one common share and one share purchase warrant

Each whole warrant entitled the holder to purchase an additional common share at a price of $0.50 for a period of 24 months from issuance.

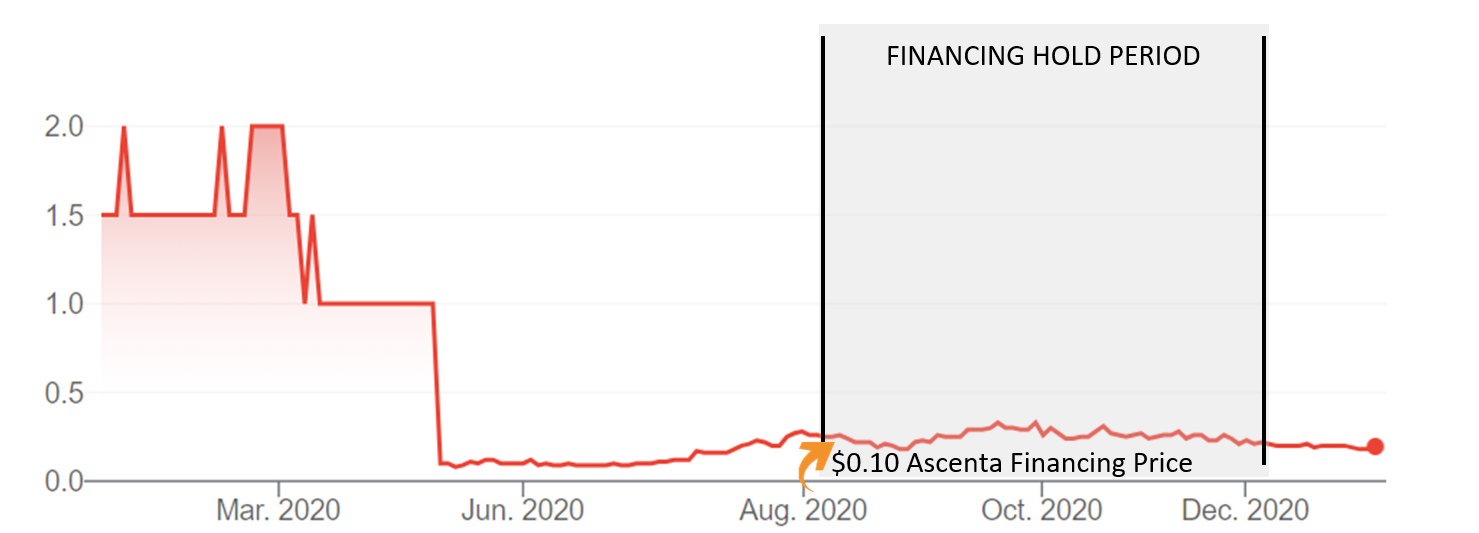

Sanatana Resources Inc. (TSXV:STA)

December 31, 2020 Closing Price as compared to Ascenta Financing Price: +100%

Offering Details:

Total Raise: $2,000,000

Non-Flow-Through Units @ $0.10 per unit

Each Non-Flow-Through Unit consisted of one common share and one half of one share purchase warrant

Each whole warrant entitled the holder to purchase an additional common share at a price of $0.18 for a period of 18 months from issuance

Flow-Through Units @ $0.12 per Unit

Each Flow-Through Unit consisted of one flow-through common share and one half of one share purchase warrant

Each whole warrant entitles the holder to purchase an additional common share at a price of $0.20 for a period of 18 months from issuance

Important Dates:

Financing Closing date: August 6, 2020

Securities Free Trading Date: December 6, 2020

Warrant Expiry Date: February 6, 2022

Price Info:

High since free-trading date: $0.21

December 31, 2020 Closing Price: $0.20

Global Battery Metals Ltd. (TSXV:GBML)

December 31, 2020 Closing Price as compared to Ascenta Financing Price: +20%

Offering Details:

Total Raise: $1,035,000

Units @ $0.10 per unit

Each unit consisted of one common share and one share purchase warrant

Each whole warrant entitled the holder to purchase an additional common share at a price of $0.15 for a period of 24 months from issuance

Important Dates:

Financing Closing date: November 10, 2020

Securities Free Trading Date: February 11, 2021|

Warrant Expiry Date: November 10, 2022

Price Info:

High since free trading: TBD

December 31, 2020 Closing Price: $0.12

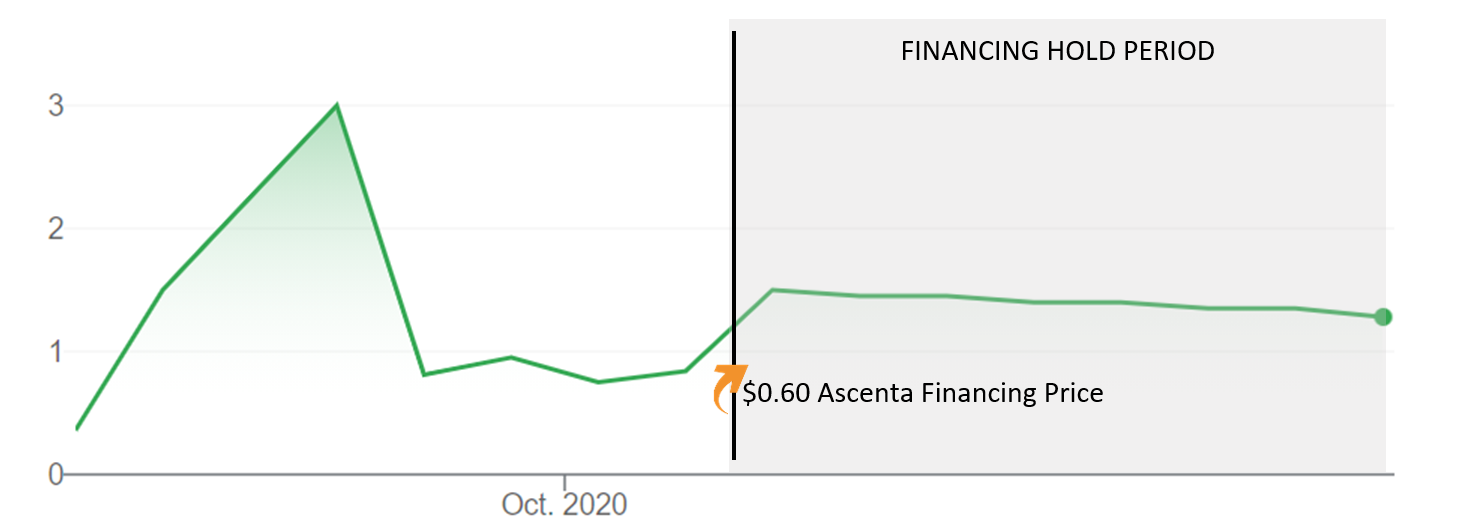

Outback Goldfields Corp. (CSE:OZ)

December 31, 2020 Closing Price as compared to Ascenta Financing Price: +113%

Offering Details:

Total Raise: $11,406,000

Units @ $0.20 per unit (post 3:1 consolidation cost, $0.60)

Each unit consisted of one common share and one share purchase warrant

Each whole warrant entitled the holder to purchase an additional common share at a price of $0.50 (post 3:1 consolidation cost, $1.50) for a period of 24 months from issuance

Important Dates:

Financing Closing date: November 16, 2020

Securities Free Trading Date: March 17, 2021

Warrant Expiry Date: November 16, 2022

Price Info:

High since free trading: TBD

December 31, 2020 Closing Price: $1.28

Bravo Zulu Drone Defense Inc. (Private)

Offering Details:

Total Raise: $2,463,700

Units @ $0.25 per unit

Each unit consisted of one common share and one half of one share purchase warrant

Each whole warrant entitled the holder to purchase an additional common share at a price of $0.35 for a period of 24 months from issuance

Important Dates:

Financing Closing date: September 11, 2020

Securities Free Trading Date: January 12, 2021

Warrant Expiry Date: September 11, 2022

Notes:

Indrocorp, the parent company of Bravo Zulu, has indicated that it intends to go public during Q2 2021 on Nasdaq.

Midex Resources Ltd.

(Private)

Offering Details:

Total Raise: $1,931,450

Shares @ $0.10 per share

Flow-Through Shares @ $0.10 per flow-through share

Important Dates:

Financing Closing date: September 24, 2020

Securities Free Trading Date: January 25, 2021

Notes:

Midex expects to be trading on the CSE in Q2 2021.

55 North Mining Inc.

(Private)

Offering Details:

Total Raise: $4,426,113

Non-Flow-Through Units @ $0.15 per unit

Flow-Through Units @ $0.20 per unit

Each unit consisted of one common share and one share purchase warrant

Each whole warrant entitled the holder to purchase an additional common share at a price of $0.30 for a period of 48 months from issuance.

Important Dates:

Financing Closing date: December 4, 2020

Securities Free Trading Date: April 5, 2021

Warrant Expiry Date: December 4, 2024

Notes:

A listing for 55 North Mining is pending and is expected for Q1 2020. The Company will trade on the CSE under symbol FFF.

Bond Offerings

NationWide Self Storage & Auto Wash is in the business of building and operating storage and auto wash facilities in BC.

In November, 2020 Ascenta assisting Nationwide in selling out its NationWide IV Self Storage & Auto Wash offering, raising $26,000,000 through the issuance of trust units. The funds will be used for the building and operation of a self storage and auto wash facility to be built in South Surrey, BC.

Trust Units were offered as follows (with the $90 Trust Units being sold first and then moving to the higher priced Units):

$90 Trust Unit yielding a 8.250% preferred base return per annum;

$100 Trust Unit yielding a 7.425% preferred base return per annum; and

$105 Trust Unit yielding a 7.071% preferred base return per annum.

In addition to interest, investor will receive:

Up to 70% participation in the returns exceeding the preferred base return – paid monthly in arrears; and

Up to 70% of the capital appreciation on the disposition of the development property

Interest accrues on the closing of the investment but is not paid out to investors until 15-30 months after closing.

Kontrol Energy Corp. is a public company which trades on the CSE under symbol KNR.

In February, 2020, Ascenta assisted Kontrol in completing an offering of Units, the details of which were as follows:

Units priced at $1,000 per Unit;

Each Unit consisted of:

A $1,000 2-year Debenture, yielding interest at 8% per annum, paid monthly; and

50 Common Shares of Kontrol Energy.

In November, 2020, Kontrol Energy launched a new offering of Units, the details of which are as follows:

Units priced at $1,000 per Unit;

Each Unit consists of:

A $1,000 2-year Debenture, yielding interest of 8% per annum paid monthly PLUS bonus interest of 1% per annum, paid annually; and

10 Common Shares of Kontrol Energy.

The shares of Kontrol Energy had a 2020 high share price of $6.64 and closed the year with a share price of $3.00 per share.

Kontrol Energy has not defaulted on any interest payments or redemptions.

Yesterpay Holdings Inc. is a Calgary-based company which raises funds, via bond offerings, for its sister company, Capital Now Inc., a factoring company serving the oil & gas industry in Western Canada.

In March 2020, Ascenta assisted Yesterpay in completing a Bond Offering. Yesterpay offered four classes of Bonds, the details of which are as follows:

Series C Bonds

1 year term

6.5% interest

Interest paid on the last day of each month

Principal repaid on maturity

Series D Bonds

2 year term

7.5% interest

Interest paid on the last day of each month

Principal repaid on maturity

Series E Bonds

3 year term

8.5% interest

Interest paid on the last day of each month

Principal repaid on maturity

Series F Bonds

3 year term

8.5% interest

Compounded monthly and paid on maturity (making an effective rate of 9.6%)

Yesterpay has not defaulted on any interest payments or redemptions.